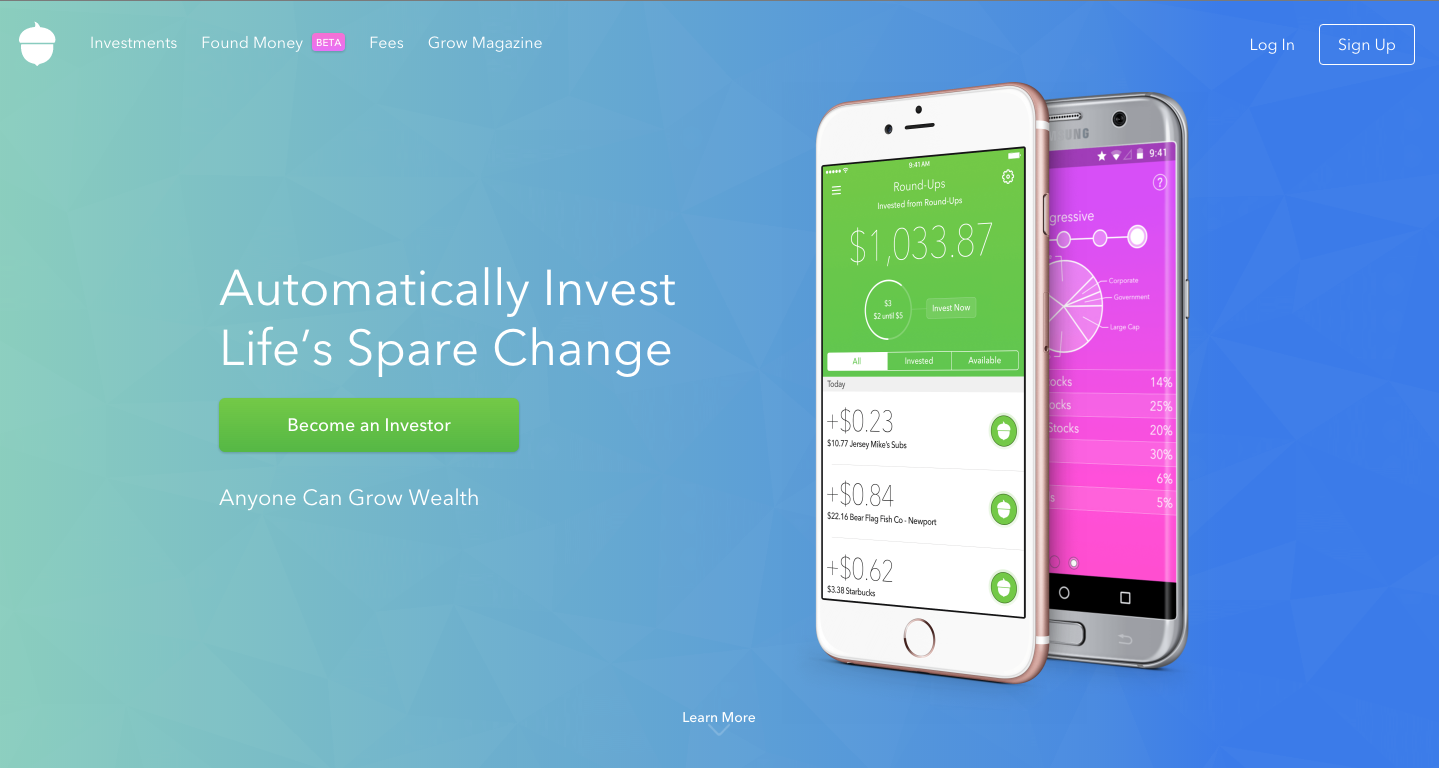

I’ve been waiting patiently to give you my Acorns Review, a company I’ve been trying out for the last thirty-seven days. Acorns, helps you invest smaller amounts of money, spare change to be more exact. They connect with an account or card of your choosing that you frequently use, then round up your purchases to the nearest dollar and invest in Exchange Traded Funds (ETFs.)

My interest for this app was peaked when I read a Acorns review by J. Money on BudgetsAreSexy. The idea that people would be able to invest as little as $5 was exciting for me. The biggest reasons people don’t start investing their money is 1. they feel like they need to have a significant amount to begin, or 2. they don’t know how to invest. First, Acorns does Micro Investing, which lets you invest smaller amounts of cash. Second, they help with the “how” and the “what” to invest. After answering a few questions, they’ll give you recommendations on what type of portfolio you should invest in, i.e. conservative to aggressive. Another great feature is you’re able to change your portfolio later if you what to be more risky or conservative at a later date.

On May 10, 2016, I set-up my account and as of today, I have $127.92. It didn’t take more than 20 minutes to get it all set-up, and that included the time I had to call customer service because there was an issue connecting my bank to my Acorn account. When I hit a snag linking my accounts, I thought “oh great this isn’t going to work out.” But I was relieved when the customer service rep I spoke with was very helpful, she immediately knew what the problem was and corrected it right away.

I made an initial $25 deposit to get my investments rolling and set my account to automatically invest round-ups. Round-ups are the difference between a purchase price and the next dollar. For example, if I spent $8.75 at a gas station, Acorns takes .25 cents to invest. Once your round-ups reach $5, then it is invested. The rest of my money has come from my roundups and return.

On May 10, 2016, I set-up my account and as of today, I have $127.92. It didn’t take more than 20 minutes to get it all set-up, and that included the time I had to call customer service because there was an issue connecting my bank to my Acorn account. When I hit a snag linking my accounts, I thought “oh great this isn’t going to work out.” But I was relieved when the customer service rep I spoke with was very helpful, she immediately knew what the problem was and corrected it right away.

I made an initial $25 deposit to get my investments rolling and set my account to automatically invest round-ups. Round-ups are the difference between a purchase price and the next dollar. For example, if I spent $8.75 at a gas station, Acorns takes .25 cents to invest. Once your round-ups reach $5, then it is invested. The rest of my money has come from my roundups and return.

Acorns Review-Things I Like

- The app and website are using friendly and easy to understand

- They have a password log-in on the app for security

- It’s easy to check my account balance and the performance of my portfolio

- You can get extra cash for referring friends

- They provided information to give you a basic understanding of the process

- They make investing uncomplicated

- It’s low-cost to invest

Acorns Review-What I Don’t Like

- They don’t clearly say the expense for each ETF—instead they link to the prospectus but for most people those aren’t an easy read. I think it should be list under fees even though ETF expenses are not fees charged by Acorns. Most people are unaware they also need to account for expenses charged by the funds they invest in.

Acorns Review Things To Know

- Set-up: You can open and account online or with the Acorns app.

- Fees: For accounts under $5,000 it’s $1 per month and .05% to .20% depending on the ETF. Accounts over $5,000, the fee, is .25%

- Dividends automatically reinvest.

- There are no commission fees.

- Investments are in $5 increments—round-ups are set aside until they reach $5 and then they’re invested. If you want to add more money to the account, you can do it at any time as a one-time or recurring investment.

- Withdrawals can take 5-7 business days, but there is not charge to withdrawal your money.

- Insurance for the account is up to $500K from the Securities Investor Protection Corporation

- Acorns rebalances your portfolio