While I was getting my business-finance degree at UNCW, I learned a key point in business that’s relevant to managing your personal finances, and that’s “keep costs low.” Now you may be thinking, “I’m not running a business, Lacey,” but I respectfully disagree. I don’t care if it’s just you or you’re Kate Gosselin with eight kids in tow. You’re running a household business because you have income and expenses to manage and, therefore, need to keep costs low to ensure you’re able to save cash for the future and pay all your expenses (I’m sure Kate would agree.)

Start the cost-cutting process by remembering what your goals are, i.e. know what you want out of your money. The goal may be to pay off debt quicker or to have enough money to pay bills each month. Either way, a goal will help you remember why you’re making sacrifices.

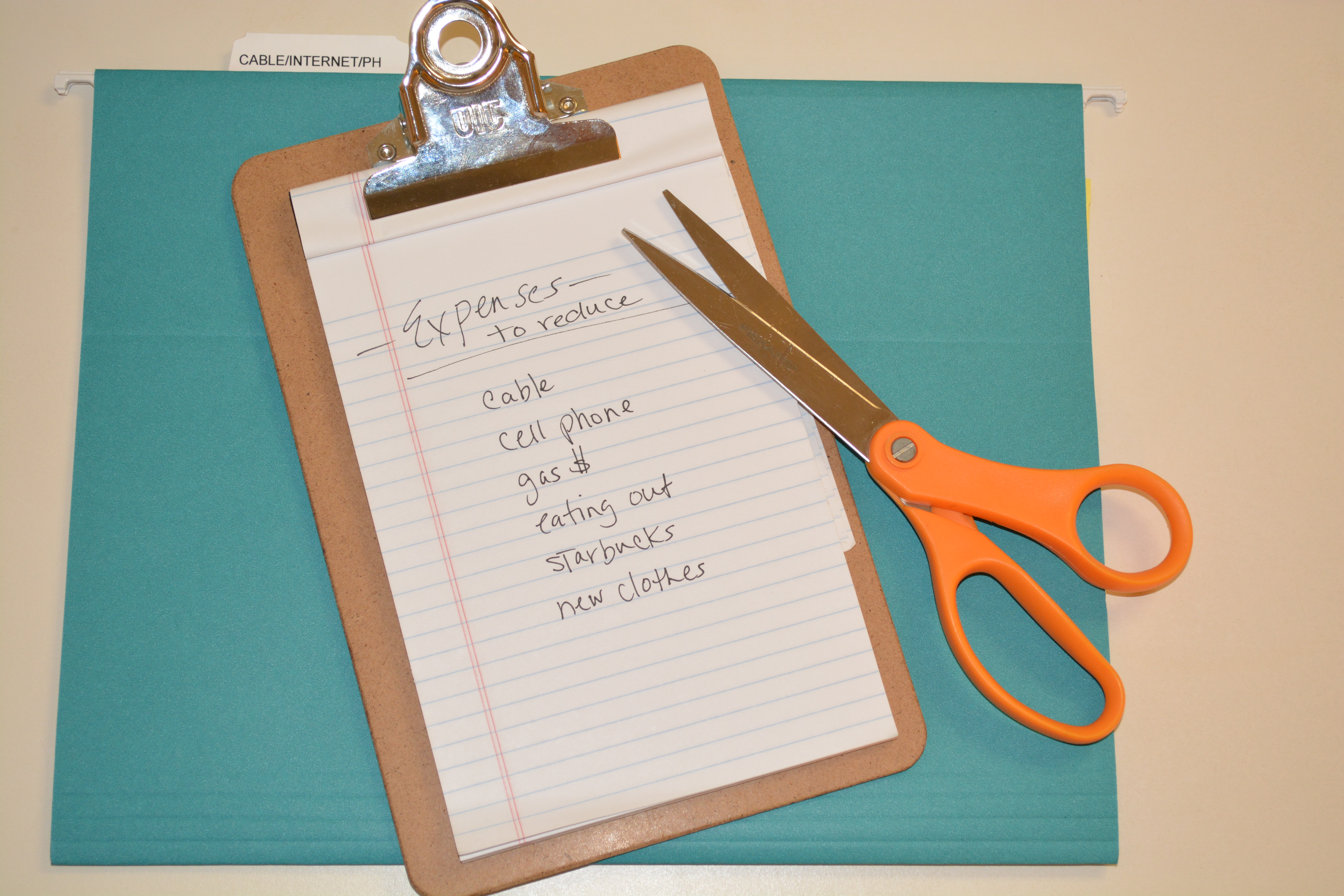

If your goal is to increase savings or pay off debt quicker, look at expenses that aren’t fixed, such as entertainment, cable, groceries, gasoline, and dining out—these are the costs to start cutting first. How you cut costs is going to be personal and best decided by you because each person has a different situation, so it’s best to do what works for you and not worry about keeping up with anyone else. Some ideas to reduce your spending are:

If your goal is to increase savings or pay off debt quicker, look at expenses that aren’t fixed, such as entertainment, cable, groceries, gasoline, and dining out—these are the costs to start cutting first. How you cut costs is going to be personal and best decided by you because each person has a different situation, so it’s best to do what works for you and not worry about keeping up with anyone else. Some ideas to reduce your spending are:

- Eat out less, cook at home more (yes, you can do it, it’s fun!)

- Drive around less (no extra trips out for a Frosty after dinner)

- Cut your cable off and play more board games with family (I love Scrabble)

- Make handmade gifts for birthdays and Christmas (this is underrated)

- Rent Redbox movies instead of going to the theater (they have free codes)

- Get Panera every other day rather than every day (get their reward card)

- Use coupons (they aren’t the ones your Grandma used anymore)